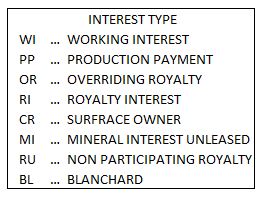

Let’s continue our series on reading a royalty statement by discussing different types of oil and gas interests that may be seen on statements. We will continue using this Example Royalty Statement (clickable link) which is formatted just like an actual producing company’s statement. In the last post we discussed a pretty straightforward part of the statement, but now we will really start getting in to the meat of the oil and gas royalty statement. There are a number of boxes in the upper right hand corner – we will discuss the box labeled “Interest Type”.

There are many types of oil and gas interests one may have relating to a lease. The individual receiving a statement from the operating company will most likely have one or more types of interests relating to the lease. Knowing what type of interest you hold will help you understand your rights and obligations. Note that this post is meant to be a brief overview of the types of oil and gas interests. Future posts by land and leasing experts will go in to great detail about many of these interests.

Types of Oil and Gas Interests

Working Interest

This is usually (but not always) the interest held by the operating company. A working interest owner does not own the minerals but rather only the right to produce them. While working interest owners have the obligation to pay all costs relating to drilling, operating, and eventually plugging well, they are only entitled to a portion of the revenue from that well. The remaining revenue is payable to various types of royalty owners.

For example, if ABC Petroleum Company was the only working interest owner in the John Doe #1-1, it would pay 100% of the costs associated with drilling, operating, and abandoning the well. However, it would receive less than 100% of the revenue from the lease. A portion of the revenue, perhaps 12.5%, would go to royalty interest owners and only 87.5% would belong to ABC Petroleum.

Production Payment

A production payment results when the revenue from a working interest is severed from the interest itself. A working interest owner may retain his or her interest in a property but assign (or sell) only the future revenue from that interest to another individual or company. Conversely, a working interest owner may assign (or sell) his or her interest in a property and retain only the revenue from that interest. Both of these scenarios results in the creation of a production payment.

Overriding Royalty

An overriding royalty interest is similar to a royalty interest (see below) in that it generally implies an interest free and clear of any drilling, operating, or plugging costs. However, an overriding royalty interest is generally not associated with ownership of mineral rights. This type of interest is generally conveyed by an operating company to an individual by reducing the operating company’s share of revenue (i.e. after the mineral owner’s royalty interest is paid).

For example, let’s say that Jane Smith is a geologist and she comes up with the idea to drill a wildcat (exploration) well. Jane Smith doesn’t own the minerals where this well is to be drilled and she doesn’t have enough money to drill a well. So, she goes to ABC Petroleum and tells them about her idea. ABC Petroleum then goes and leases the minerals and drills a well. In return for Jane Smith’s idea, she is granted 2.5% of the revenue from the oil company’s working interest as an overriding royalty interest.

Royalty Interest

A royalty interest generally implies an interest free and clear of any drilling, operating, or plugging costs – although it may sometimes be required to pay costs associated with transportation or processing of oil and gas. An oil and gas royalty interest is generally reserved by a mineral owner upon signing a lease. The oil and gas lease will specify the percentage of production that will be conveyed to the mineral owner, whether as a payment or taken in-kind.

As an example, let’s say that John Doe leases his minerals to ABC Petroleum and the lease specifies a 12.5% royalty payment. Later, ABC Petroleum drills a well on the lease and establishes production. According to the lease, 12.5% of all production is reserved by John Doe. Depending on the terms of the lease, he may physically take possession of production at the well, or he may allow ABC Petroleum to process, store, transport, and market oil and gas on his behalf and send him a royalty payment.

Surface Owner

The surface owner is the individual, corporation, or entity owning the land on which a well is drilled or facilities and roads are built. The surface owner does not necessarily own the mineral rights underneath the land. Before an oil company can drill a well, it must work with the surface owner and sign a surface use agreement. This is the legal document that gives the oil company the right to disturb the surface. In return for building drilling pads and roads which damage the surface land it is customary for an oil company to reimburse the surface owner for the damages. Payments to the surface owner may be one time or recurring payments.

Mineral Interest Unleased

In some cases, unleased minerals may be force pooled in order to create a drilling unit. Force pooling regulations vary by state, but essentially, if an oil company has leased a majority of the minerals in an area, it can force mineral owners who have not signed a lease to make a decision (as specified by the state). If he or she chooses not to sign a lease he or she obtains an unleased mineral interest by either:

a) Participating in the well and becoming both a working interest and royalty owner. That is, he or she must pay for his or her proportionate share to drill and operate the well and in return receive 100% of the revenue from the interest (as opposed to the revenue less a royalty payment).

b) Electing non-consent in a well, declining to pay his or her proportionate share of the well. By electing non-consent, he or she will still receive a royalty proportionate to the mineral interest (at a state mandated royalty rate). After the oil company has recovered two or three times the cost of drilling the well (as determined by the state), the unleased mineral owner will begin to receive 100% of the revenue from the mineral interest, less his or her proportionate operating cost.

Non-Participating Royalty

A non-participating royalty results when the revenue or royalty payments associated with a mineral interest are severed from the mineral interest itself. The owner of a non-participating royalty is entitled to royalty payments from a mineral interest but has no ownership of that interest. Because the non-participating royalty owner does not own the mineral interest, he or she does not have executive rights to lease or make legal decisions relating to the minerals.

Blanchard

This type of oil and gas interest is specific to the state of Oklahoma and is a result of the 1963 Oklahoma Supreme Court Blanchard Decision. Ultimately, the decision resulted in Oklahoma Senate Bill 168 which established state-wide regulations for payment of gas royalties from communitized or pooled leases.

1 Comment