Oil and gas royalty statements are often confusing and difficult to read, but understanding how to read oil and gas royalty statements is probably the most important thing a royalty owner should be able to do. There is a lot of information on a royalty statement, so I will address the topic in a few consecutive posts. If there is a producing well on your minerals, you most likely receive a statement with each of your royalty checks – if you do not receive a statement, you should contact the operating company right away.

Statements from operating companies may look very different, but they all have some common elements. In this series of posts, I will review these common elements as shown in this Example Royalty Statement (clickable link) which is formatted just like an actual producing company’s statement. As I discuss each element, I will include images taken from the example statement.

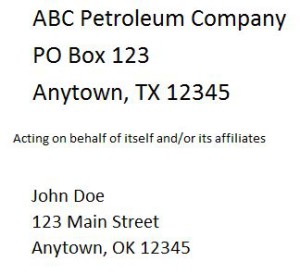

The first part of the statement we will discuss is the address section in the upper left hand corner. This is relatively self-explanatory, but there are still some important things we can learn by discussing this part of the statement.

It’s pretty obvious that ABC Petroleum Company has sent this royalty statement and that correspondence with the company can most likely be sent to the address listed. What is interesting is the text “Acting on behalf of itself and/or its affiliates”. So, what does that mean? Basically, this is telling John Doe that this royalty payment may or may not be due to minerals he has leased to ABC Petroleum Company.

Perhaps Mr. Doe actually leased his minerals to Gusher Oil Company, but the acreage was not sufficient to drill a well. So, Gusher Oil combined its acreage with acreage ABC Petroleum had leased from another mineral owner. The combined acreage from both companies was enough to form a drilling unit and drill a well. In this example, let’s say ABC Petroleum contributed more acreage than Gusher Oil so ABC Petroleum gets to operate the well, but costs and revenue are shared between the companies. Mr. Doe’s royalty payment is based upon the minerals he leased to Gusher Oil, but because ABC Petroleum operates the well, his royalty statements are actually sent by ABC Petroleum on behalf of its affiliate (in this well at least), Gusher.

Conversely, let’s suppose Mr. Doe did lease his minerals to ABC Petroleum Company, and the acreage was sufficient to drill a well. In this case, ABC Petroleum is the only company with an interest in the well and therefore operates the well. In this case, the royalty statement is sent by ABC Petroleum on its own behalf.

Hopefully, that wasn’t too confusing, but if it was, take comfort in knowing that oil and gas companies have entire departments devoted to figuring these things out. Future posts will go into great detail about how oil and gas companies work together to create units and drill wells.

Finally, let’s talk about Mr. Doe’s address. I’m sure Mr. Doe knows where he lives, but if he moves, ABC Petroleum doesn’t know where lives. I say this to remind you to inform the lessee (the company to which you leased your minerals) whenever you have a change of address. Note that most operating companies do not go to great efforts to track down a royalty owner’s new address. Companies are required by law, however, to hold royalties in escrow when the royalty owner cannot be located.

1 Comment