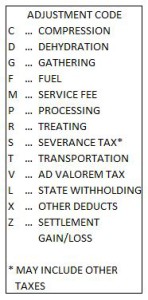

Let’s continue the discussion on the various types of royalty statement deductions  and adjustments you may encounter (Part I can be found here). In this continuation of my series on interpreting oil and gas royalty statements we will refer again to an Example Royalty Statement (clickable link). We will focus our discussion around the adjustment codes listed in the upper-right of the page. These adjustment codes explain royalty statement deductions (and sometimes credits) that are common to oil and gas producers.

and adjustments you may encounter (Part I can be found here). In this continuation of my series on interpreting oil and gas royalty statements we will refer again to an Example Royalty Statement (clickable link). We will focus our discussion around the adjustment codes listed in the upper-right of the page. These adjustment codes explain royalty statement deductions (and sometimes credits) that are common to oil and gas producers.

Royalty statement deductions explained

Severance tax

It’s been said that the only certain things in life are death and taxes. And if you are a royalty owner, you get a nice share of the latter in the form of oil and gas production taxes. Severance tax is collected by the state on all oil and gas production. It is generally a percentage of total sales revenue, varying by state from about 2% to 8%. In some states the severance tax is reduced on production from low rate oil and gas wells or enhanced oil recovery projects (water or CO2 floods). Severance tax is paid by both the producing company and the royalty owner.

In states with significant oil and gas production, severance taxes are a vital source of funding for public schools and law enforcement. Unfortunately, due to current low oil and gas prices, many states are struggling to fund public services because of the decrease in severance taxes paid by oil and gas produces and royalty owners.

Ad valorem tax

This oil and gas production tax is levied by the county. In much the same way as property tax on your home, ad valorem tax is generally a mill levy on the assessed value of your minerals or royalty interest. This assessment may be based on some decimal multiplier of annual oil and gas production or it may be based on the estimated value of a well’s future production. In some counties, the royalty owner may have the option of selecting assessment method.

When the royalty owner has the option of paying ad valorem tax based on estimated future production rather than on current production rates, it may be advantageous to have a registered professional engineer prepare this estimate. This would be particularly applicable in cases when the taxes are for a new well that is producing at its highest rates (because production decreases rapidly after the well is first turned to production, and the value of estimated future production may yield a lower assessed value). If you would like to have a professional engineer prepare an estimate of the future value of oil and gas production from your royalty or mineral interests, we at Petrolitix can help you with this.

Transportation

When oil and gas is produced, it must ultimately reach an oil refinery or gas treatment plant. Whether produced oil and gas reach the refinery or gas plant by pipeline or truck (for oil), there is an associated cost. The cost may be in the form of a pipeline tariff or trucking fees, but generally the royalty owner is responsible for the expense to transport his or her share of the production. Again, this depends entirely on the lease terms, so if you have questions, refer to your lease or contact a professional landman (Petrolitix can refer you to a reputable landman).

State withholding and Other deducts

These are generic “catch-all” deductions that may be applied for various reasons. If you see these withholdings on your production statement, it would be best to contact the owner relations department of the producing company.

Settlement gain/loss

This adjustment relates to how the gas processing plant makes a profit. If the gas processing plant does not collect a fee for it services, as discussed in the topic “Processing” in Royalty statement deduction – Part 1, it will take a percent-of-proceeds. This means that the plant will keep a percentage of the natural gas it processes or of the natural gas liquids (NGLs) it extracts. The value of the gas processing plant’s percent-of-proceeds is deducted using this code.

For a further discussion on natural gas production and processing, see the topics “How gas is separated and sold” in The oil and gas production process and “Plant condensate” in Royalty statement product codes.

If you have questions about your royalty statement deductions, we at Petrolitix would be happy to help answer those questions. You may contact us by clicking here.