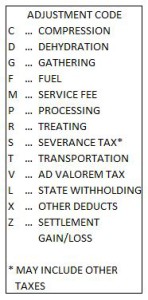

Now that I have introduced a few basics of oil and gas production, I would like to cover various types of royalty statement deductions and adjustments you may encounter. In this continuation of my series on interpreting oil and gas royalty statements we will refer again to an Example Royalty Statement (clickable link). We will focus our discussion around the adjustment codes listed in the upper-right of the page. These adjustment codes explain royalty statement deductions (and sometimes credits) that are common to oil and gas producers. There is a lot of information to cover here, so I will break this into two parts.

It is important to note that even though royalty interests are free and clear of any operating costs, some payment adjustments may be applicable depending on the terms of the lease. The lease will specify at what point a royalty owner is paid or may take his or her production in-kind.

If the lease specifies this occurs at the wellhead, then the royalty owner must pay his or her share of costs to separate, process, and transport oil and gas from that point onward. If the lease specifies that the royalty owner is paid or may take possession of production at the sales point, then he or she shares the costs incurred only after the sales point. The sales point for oil is generally considered to be the location where oil exits the production tanks either by truck or pipeline. Gas is generally sold at a production battery meter before it enters a gathering pipeline and is transported to the purchaser’s gas plant for further processing.

There have been significant lawsuits regarding which cost adjustments can be applied to royalty interests. As a royalty owner, if you feel deductions have been improperly applied to your payments, you might consider a review by a landman or professional engineer. Petrolitix offers professional engineering services and can also refer you to land professionals.

Royalty statement deductions explained

Compression

After natural gas reaches the surface and is separated from liquids (oil and water) at the production battery, it can be at relatively low pressure – around 40 psi. Occasionally, the pipeline that gathers gas after it is sold operates at a much higher pressure. Before the gas can be sold it must be compressed so that it is at a higher pressure than the gathering pipeline. The cost to operate compressors is passed on to interest owners as a compression adjustment.

Dehydration

Although natural gas is initially separated from water and oil at the production battery, the separation is not complete. Some amount of water vapor is generally entrained in the natural gas after initial separation. Too much water vapor in a natural gas pipeline can result in severe corrosion or the formation of an ice-like substance called a natural gas hydrate. In order to prevent these problems (and to meet contractual agreements with the gas purchaser) gas may require dehydration before it can be sold. Various types of liquids (glycols) as well as solids (alumina or silica gel beads) are used as desiccants to dehydrate the gas. These treatment costs are also passed on to interest owners.

Gathering

Gathering refers to the collection and transportation of natural gas by pipeline from the production battery to a natural gas processing facility. In the industry, the facility where natural gas is processed is usually referred to as a gas plant. The cost to install and maintain this network of gathering lines is passed on to the working and royalty interest owners as a fee per volume of gas transported (i.e. per Mscf – thousand standard cubic feet).

Fuel

Fuel refers to produced natural gas that is burned during the production process. This may take place at the production battery in the heater treater (part of the oil and water separation process), in a heat trace system (used to prevent water tanks from freezing), or in gas-fired compressors and generators. Natural gas is also used as fuel at the gas plant. Contractual agreements between the oil company and the gas purchaser will dictate whether or not the fuel gas is purchased. You will find that the gas plant always gets its cut of production – whether it is in free fuel gas or a percentage of the natural gas liquids it recovers.

Service Fee

A service fee does not necessarily refer to any particular cost related to the production process. It can be used to cover all types of miscellaneous charges.

Processing

Processing refers to the removal of natural gas liquids (NGLs) from produced natural gas. Natural gas at the wellhead is composed of hydrocarbon molecules including methane, ethane, propane, butane, and many others. Propane and butane (as well as a multitude of other molecules not mentioned here) are referred to as natural gas liquids and are stripped from the produced gas at the gas processing plant. This is done because the NGLs are generally worth more if they can be sold as individual components rather than mixed with a natural gas stream. Working and royalty interest owners are either paid for their share of the NGLs or can take the NGLs in-kind at the gas plant outlet. We will talk more about this (settlement gain/loss) in my next post on royalty statement deductions

Treating

Treating refers to the removal of impurities from produced natural gas. This also takes place at the gas plant. Natural gas at the wellhead is often composed of gasses that cannot be sold or are actually toxic. Carbon dioxide and hydrogen sulfide are the primary gasses that must be removed from the gas stream. Carbon dioxide is not toxic, but it must be removed as it will cause severe corrosion in equipment and pipelines. Hydrogen sulfide not only corrodes metal but also is extremely toxic at low concentrations. Hydrogen sulfide is the rotten egg smell at a sewage treatment plant – but don’t worry, as long as the gas still smells bad you are not in immediate danger.

I’ll end it here for today – it’s been a lot of typing. I will pick with a discussion of severance taxes in my next post on royalty statement deductions.