I will conclude my series on Oil and Gas Royalty Statements with a detailed discussion on royalty payment calculations. Without a thorough understanding of what these calculations mean, it is impossible to verify the accuracy of a payment. Reviewing royalty payment calculations is the easiest way for a mineral owner to understand what is happening on his or her oil and gas lease. Inaccurate royalty payments will almost always go unnoticed if statements are not understood and consistently reviewed. Once again, we will use our Example Royalty Statement (clickable link) to work through a few royalty payment calculations.

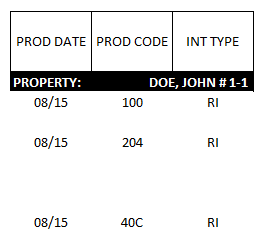

Notice on the example statement that there are calculations for different properties – John Doe 1-1, Jane Doe 13H, and Big Valley 1. We will work through calculations for the John Doe 1-1, but the calculations work exactly the same for the other two leases shown on the example royalty statement.

Production and ownership details

The first information relevant to calculations are the columns labeled “PROD DATE”, “PROD CODE”, and “INT TYPE”. “PROD DATE” is the production month of interest – in this case August 2015. Note that in some cases oil and gas royalty statements may have multiple months of production, particularly when royalty payments are small; often no payment is made until the royalties due exceed a minimum dollar amount. “PROD CODE” is the type of product produced. The upper right corner of the royalty statement gives a description of each product code. In this case, the John Doe 1-1 produced oil (100), natural gas (204), and plant condensate (40C). If you are unfamiliar with these terms or would like to know more about these products, see my previous post on this topic: “Royalty Statement Product Codes“.

“INT TYPE” is the code for the type of interest the statement recipient holds in the property. We see from the list of interest types in the upper right corner of the statement that “RI” corresponds to a royalty interest. A previous post in this series, “Types of Oil and Gas Interests“, describes each of these interest types in detail.

Production volumes and prices

Now that we know we are looking at calculations for a royalty interest on August 2015 production we will keep visible only the “PROD CODE” column, adding whatever information is necessary for the next step of calculations. First we will discuss what is called “gross” production and revenue – that means all oil and gas produced and its value before taxes and royalties are paid.

“PROPERTY QUANTITY” is the total production for each product type. In this case, the John Doe 1-1 produced 540 barrels oil (PROD CODE 100), 1,080 Mcf gas (PROD CODE 204), and 420 gallons plant condensate (PROD CODE 40C). Oil production is measured in units of barrels, which is generally shortened to “bbls”. One barrel is equal to 42 gallons. Natural gas production is measured in units of “Mcf” or “Thousand Cubic Feet” at standard conditions. Standard conditions are 60 degrees Fahrenheit and 14.7 psi.

The “PRICE” column gives the average sales price for each product during the month; so, oil sold for $45.30 per bbl, gas sold for $2.60 per million btu, and plant condensate sold for $0.65 per gallon. Note that “btu” stands for “British Thermal Unit” and is a unit of measure for energy; often “million” is replaced by “MM” so “MMbtu” is short for “one million British thermal units”.

It is very important to understand the “BTU” column. Remember that natural gas production is measured by volume (Mcf or thousand cubic feet) but it is sold based on its energy content. Not all natural gas is created equal, so the “BTU” column has a multiplier that corrects for any difference in energy content the produced gas may have. In this case the natural gas has a BTU factor of 1.06 which means 1 Mcf is 1.06 times more valuable than 1 MMbtu.

Now, our “PROPERTY GROSS VALUE” is just the volume of product produced multiplied by its price (and in the case of natural gas, by its BTU factor).

540 bbl oil x $45.30/bbl = $24,462.00

1,080 Mcf gas x $2.60/MMbtu x 1.06 MMbtu/Mcf = $2,976.48

420 gal condensate x $0.65/gal = $273.00

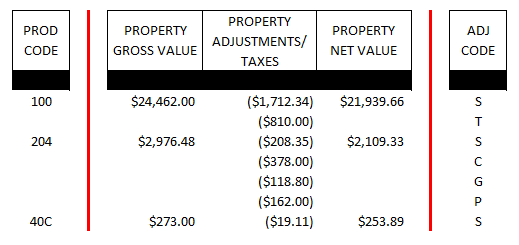

Property adjustments

Now that we have calculated the “PROPERTY GROSS VALUE” of oil, gas, and condensate produced, we need to understand what expenses and taxes must be deducted before we reach our “PROPERTY NET VALUE”. In two previous posts, “Royalty Statement Deductions – Part 1” and “Royalty Statement Deductions – Part 2“, I discuss each of these adjustments in detail.

For “PROD CODE 100” (oil) we have two adjustments – the first adjustment of ($1,712.34) corresponds to “ADJ CODE” or adjustment code “S” for severance tax. The second adjustment of ($810.00), has an adjustment code of “T” for transportation. Note that parentheses around an amount indicate it is a deduction , or negative. Our “PROPERTY NET VALUE” for oil is simply our “PROPERTY GROSS VALUE” less the adjustments.

$24,462.00 – $1,712.34 – $810.00 = $21,939.66

Similarly, for “PROD CODE 204” (natural gas) we have multiple adjustments: ($208.35) for “S” or severance tax, ($378.00) for “C” or compression, ($118.80) for “G” or gathering, and ($162.00) for “P” or processing. “PROPERTY NET VALUE” is calculated as “PROPERTY GROSS VALUE” less each of the adjustments.

Finally, “PROD CODE 40C” (plant condensate) has only one adjustment ($19.11) for “S” or severance tax.

When the “PROPERTY NET VALUE” for each product is added together it gives the total revenue from the property (oil, natural gas, and plant condensate) that is shared among royalty owners and the operating companies. In this case, the value of all products produced in the month after taxes and deductions is:

$21,939.66 (oil) + $2,109.33 (gas) + $253.89 (plant condensate) = $24,302.88

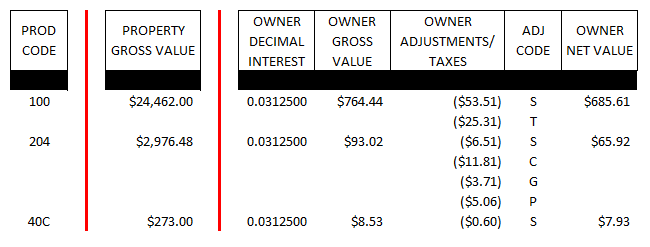

Royalty payment calculations

Now that we have calculated the revenue to be shared among the royalty owners and operating company, let’s look at how the royalty owner’s share is calculated.

We will start with the “PROPERTY GROSS VALUE”, which we already calculated, and multiply it by the “OWNER DECIMAL INTEREST” to give the “OWNER GROSS VALUE”. For “PROD CODE 100” (oil):

$24,462.00 x 0.0312500 = $764.44 (OWNER GROSS VALUE)

The calculations are identical for both of the other products. Note that your “OWNER DECIMAL INTEREST” should be found on a “Division of Interest” form provided to you from the operating company.

Remember that our “PROPERTY GROSS VALUE” was before taxes and expenses were removed, so we now need to deduct the royalty interest’s share of expenses from the “OWNER GROSS VALUE” we just calculated. The royalty owner’s share of expenses are given in the “OWNER ADJUSTMENTS/TAXES” column.

Note that in this case, the adjustments are the same as those seen in the “PROPERTY ADJUSTMENTS/TAXES” we have already looked at, except that they are multiplied by the “OWNER DECIMAL INTEREST”. For example, look at the property adjustment for oil of ($1,712.34), which the “ADJ CODE” indicates is severance tax – if we multiply that amount by the “OWNER DECIMAL INTEREST” of 0.0312500 we get $53.51 – which is exactly what we see for oil severance tax in the “OWNER ADJUSTMENTS/TAXES” column.

Now, each “OWNER ADJUSTMENTS/TAXES” item is subtracted from “OWNER GROSS VALUE” we reach the “OWNER NET VALUE” for each product. When the “OWNER NET VALUE” for all products (oil, gas, and condensate) are added together, you have then calculated the royalty payment for the property. Now that we have worked through the royalty payment calculations for the John Doe 1-1, we see that the total royalty payment for the property for August 2015 is

$685.61 (oil) + $65.92 (gas) + $7.93 (condensate) = $759.46

If this process is repeated for each property on the royalty statement and the results added together, it should match the value of your royalty check.

What if my royalty payment calculations don’t match my royalty check?

The best solution to a problem like this is to make sure you are right . . . and then check again. If things still don’t match up, call the phone number on your royalty statement and ask to speak to someone in the owner relations department. If that doesn’t resolve the problem, or if it raises more questions, it might be time to seek outside help. Here at Petrolitix, we are able to help you resolve all types of issues relating to minerals and royalties – you can reach us directly through our contact form here.

Hi,

I have been receiving “Royalty” checks since 2013 and in the beginning they were very good amounts. After 2015 they began to drop, which was expected with the drop in oil and gas prices. But, over the last couple of years the have been $100 up to $500 with some months not ever receiving a payment. As I try to determine how to take all this I came across your site explaining how to interpret royalty checks/payment statements. “Thank You for that” As I read I realized I was calculating the numbers correctly, but I also realized that our statements have items that you didn’t cover as well as many deductions large enough to completely cancel out the payment amounts. Sometimes our check that would have been $1000. or more were only a couple of hundred because of all the deductions. I need someone who is familiar with oil & gas to explain how this works in cases such as the ones I described, and I was hoping you could do that or at the very least point me in a direction to research the how and why of all this.

For informational purposes I have royalties in two (2) wells in S. Texas “Eagle Ford Shale”. They are primarily Gas but also pump Oil.

Thank You,

S.Shelton

Thank you for your comment.

As you note, the current price environment has an enormous impact on royalty payments, however, there is another factor to consider. When you began receiving royalty payments in 2013, well production was most likely at its highest, immediately after the well was completed. As soon as a well is turned to production, reservoir pressure begins to drop due to depletion, resulting in decreased production. By the time a horizontal shale well (such as in the Eagle Ford) has been producing for a few years, it will make only a small fraction of it’s original rate.

In the oil and gas industry, we refer to this as production decline. The continually decreasing production can be mathematically modeled using decline curve analysis to predict what future production rates (and royalty payments) may be. Feel free to contact us at Petrolitix if you are interested in learning how we can assist royalty owners in this area.

You mention that in some months you do not receive a royalty payment at all. In many oil and gas leases there is a provision that allows the operating company to withhold payments until the sum of monthly payments exceeds a minimum amount. Once this threshold is met, the operating company sends a combined payment for the prior months. It might be worth taking a close look at your lease to see if this is the case.

If you have other concerns about the royalty payments you have (or have not) received, feel free to contact us about the research services we can provide.